Client Alert

Fundraising of Alternative Investment Funds –A Step Forward in Adopting the New Measures on Pre-Marketing

October 15, 2018

By By Eriprando Guerritore & Désirée Catalano

1. No Pre-Marketing Measures Under the Current EU Framework

As of today EU laws and regulations do not provide for a harmonized pre-marketing notion nor for a set of rules on pre-marketing activities.

Each EU National Competent Authority has therefore come up - or not come up - with its own interpretation about activities qualifying as pre-marketing or safe harbored from pre-marketing.

According to:

French National Competent Authority’s (“Autorité des Marchés Financiers”) view, managers may contact up to 50 professional investors prior to launching a fund project, but they are not allowed to disseminate any documentation containing information about the fund;[1]

German National Competent Authority’s (“Bundesanstalt für Finanzdienstleistungsaufsicht”) view, pre-marketing is allowed as long as the activity carried out cannot be considered as an offer of a specific investment undertaking, no specific questions on the product are answered and finalization of the fund terms is still ongoing;[2]

Luxembourg National Competent Authority’s (“Commission de Surveillance du Secteur Financier”) view, managers may present draft documents prior to fund launches as long as they are not used by the prospective investors to formally subscribe or commit to subscribe shares or units of the fund;[3]

U.K. National Competent Authority’s (“Financial Conduct Authority”) view, sharing draft fund terms with cornerstone investors prior to fund launches qualifies as pre-marketing so alternative investment fund managers do not need to notify the regulator about their pre-marketing activities.[4]

In turn Italy has not adopted domestic measures ruling pre-marketing. Any analysis on whether or not an activity qualifies as pre-marketing shall therefore be carried out on a case by case basis.

2. The Rationale for Introducing New Measures on Pre-Marketing

In a nutshell the new measures are aimed at easing the launch of new alternative fund projects by:

Removing regulatory barriers to cross-border distribution of alternative investment funds, such as regulatory fees;

Enhancing the transparency level of rules on pre-marketing / marketing leveling the playing field; and

Creating a harmonized definition of pre-marketing, limiting each single Member State’s discretion in identifying pre-marketing activities.

3. The New Draft Measures on Pre-Marketing

On 21 September 2018 and 2 October 2018 the ECON[5] published two draft reports[6] relating to EU Parliament proposals on cross-border distribution of collective investment funds amending, inter alia, the AIFMD[7] (respectively the “Reports” and the “Proposals” and the Reports and the Proposals collectively the “Draft Measures”).[8] The Reports introduce a number of amendments to the Proposals with reference, inter alia, to the notion of pre-marketing and to the rules on pre-marketing without disregarding the necessity to provide sufficient safeguards against potential circumvention of the AIFMD requirements.[9]

3.1 The Pre-Marketing Notion

Abridged Considerations

Pursuant to the Draft Measures pre-marketing shall mean:

A direct or indirect provision;

The provision may occur by any means (email, hard copy, etc.);

The form by which any information or communication is provided is of no relevance (e.g., written form vs. oral form);

On investment strategies or investment ideas;

The investment strategy / idea notion is unclear and should be better clarified. For instance, one may argue the information under this box is limited only to: asset class of relevance, asset allocation, risk-income profile, and rationale of the investment idea;

By an EU AIFM or on its behalf;

For instance, by a distributor acting on the EU AIFM’s behalf based on a distribution agreement;

Reference should be made to potential investors having a risk-income profile matching the one of the investment strategy / investment idea notwithstanding the new MIFID II measures - as applying to EU AIFMs / distributors - on target market reference;

In order to test their interest in an AIF or a compartment of an AIF;

No binding commitment into an AIF - or a compartment of an AIF - may be executed based on any pre-marketing activity;

Which is not yet established in the Member State where the potential EU investors are domiciled or have their registered office.

No pre-marketing with reference to existing AIFs / any of their existing compartments (cells) based on current language under the Draft Measures.

3.2 The Pre-Marketing Rules

The Pre-Marketing Rules

Abridged Considerations

Member States shall ensure that an authorized EU AIFM may engage in pre-marketing in the Union, excluding where the information presented to potential professional investors relates to an established AIF / contains reference to an established AIF / enables investors to commit to acquiring units or shares of a particular AIF / amounts to a prospectus, constitutional documents of a not yet established AIF, offering documents, subscription forms, or similar documents, whether in a draft or a final form, allowing investors to take an investment decision;

Pre-marketing is limited only to EU AIFMs with the exclusion of non-EU AIFMs. Further, only “full-scope” EU AIFMs may take advantage of the pre-marketing rules, excluding therefore “registered” EU AIFMs, which may not carry out any pre-marketing activities based on current language under the Draft Measures.

Member States shall ensure no requirement to notify the competent authorities of pre-marketing activities is necessary for an EU AIFM to engage in pre-marketing activities;

Pre-marketing may be carried out without any advanced notification based on a self-assessment carried out by each “full-scope” EU AIFM on a case by case basis;

AIFMs shall ensure thatinvestors, within 18 months of being contacted as part of pre-marketing, may acquire units or shares in the AIF or compartment of the AIF referred to in the information provided in the context of pre-marketing or of an AIF or compartment of an AIF established as a result of thepre-marketing only undermarketing permitted under Article 31 (“Marketing of units or shares of EU AIFs in the home Member State of the AIFM”) or 32 (“Marketing of units or shares of EU AIFs in Member States other than in the home Member State of the AIFM”) of the AIFMD.

EU AIFMs may not enjoy “reverse enquiry safe harbour exemptions” based on any pre-marketing activity started by them. Any potential investor approached during a pre-marketing activity may execute binding subscriptions only subject to the marketing procedure set forth under the AIFMD.

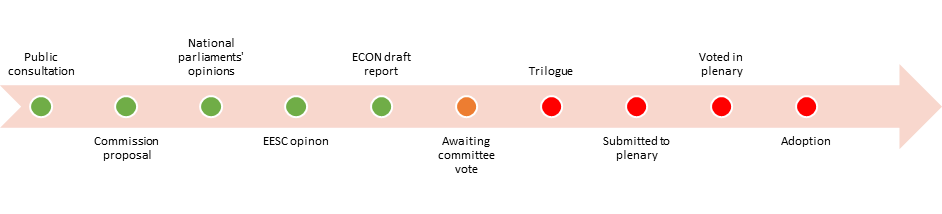

4. Expected Timeline

The European Commission is seeking to adopt the Proposals by May 2019.

The European Commission is seeking to adopt the Proposals by May 2019.

[1] In this regards please make reference to the following link: https://www.amf-france.org/en_US/Actualites/Communiques-de-presse/AMF/annee-2016?docId=workspace%3A%2F%2FSpacesStore%2F9456b35b-c749-4ed2-8a0e-8f6bc8a67815.

[2] In this regards please make reference to the following links:

https://www.bafin.de/SharedDocs/Downloads/EN/Veranstaltung/dl_290617_Brexit_Workshop_TOP_4.pdf?__blob=publicationFile&v=3 (page 5); and

http://www.bafin.de/SharedDocs/Downloads/DE/Rede_Vortrag/dl_151130_Seminar-Investmentrecht_H%C3%A4ufige%20Fragen.pdf?__blob=publicationFile&v=6 (page 22 / available only in German language).

[3] In this regards please make reference to the following link http://www.cssf.lu/fileadmin/files/AIFM/FAQ_AIFMD.pdf (page 45).

[4] In this regards please make reference to the following link https://www.handbook.fca.org.uk/handbook/PERG/8/37.html (PERG 8.37.6).

[5] Reference is made to the European Committee on Economic and Monetary Affairs.

[6] Draft report on the proposal for a directive of the European Parliament and of the Council amending Directive 2009/65/EC of the European Parliament and of the Council and Directive 2011/61/EU of the European Parliament and of the Council with regard to cross-border distribution of collective investment funds (2018/0041(COD)) and the Draft report on the proposal for a regulation of the European Parliament and of the Council on facilitating cross-border distribution of collective investment funds and amending Regulations (EU) No. 345/2013 and (EU) No. 346/2013 (2018/0045(COD)). The Reports are available on the following websites: https://service.betterregulation.com/sites/default/files/upload/2018-09/document%2867%29.pdf and http://www.europarl.europa.eu/sides/getDoc.do?type=COMPARL&reference=PE-627.812&format=PDF&language=EN&secondRef=01.

[7] Reference is made to the Directive 2011/61/EU of the European Parliament and of the Council of 8 June 2011 on Alternative Investment Fund Managers.

[8] The Proposals consist of: (i) a Directive on the cross-border distribution of collective investment funds; and (ii) a Regulation setting out a harmonised EU framework on required marketing communications, an online transparency framework for national provisions on marketing requirements, and amendments to Regulation (EU) 345/2013 on European Venture Capital funds and Regulation (EU) 346/2013 on pre-marketing.

[9] A new definition of pre-marketing should be introduced under current Article 4(1) of the AIFMD. Further pre-marketing will be permitted under new Article 30a of the AIFMD.

[10] Amendment to Article 4, paragraph 1 of the AIFMD.

[11] General comment: Any wording in bold and italics under paragraphs 3.1 and 3.2 relates to new additions and comments set forth under the Reports.

[12] I.e., any professional investor domiciled or registered in the European Union, such as EU insurance companies.

[13] Reference is made to Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments.

[14] Reverse enquiry refers to investment in AIFs by professional investors made on their exclusive initiative. Reference is made to recital (70) of the AIFMD pursuant to which “this directive should not affect the current situation, whereby a professional investor established in the Union may invest in AIFs on its own initiative irrespective of where the AIFM and/or the AIF is established”.