Client Alert

European Derivatives Regulation: Spotlight on the European Markets and Infrastructure Regulation (“EMIR”)[1] - Where Are We Now? - Part 2 Summer 2015

July 21, 2015

By Karen Stretch, Karina Bielkowicz, Christian Parker & Charlotte Brearley

“For the European derivatives market, 2015 is set to be the year in which the final pieces of the regulatory jigsaw are finally put in place, comprising rules on electronic trading, transparency and margin, as well as the implementation of central clearing for standardised swaps.”[2]

16 August 2015 will mark the three year anniversary of EMIR taking effect but has 2015 so far seen the “final pieces of the regulatory jigsaw” put in place, and if not, what remains outstanding? This Stay Current provides a status update on the implementation of EMIR following our 2013 “European Derivatives Regulation: Spotlight on the European Markets and Infrastructure Regulation (“EMIR”) client alert[3] and is intended to provide a summary “where are we now” guide as well as a more detailed insight into how the implementation of EMIR is progressing and expected next steps.

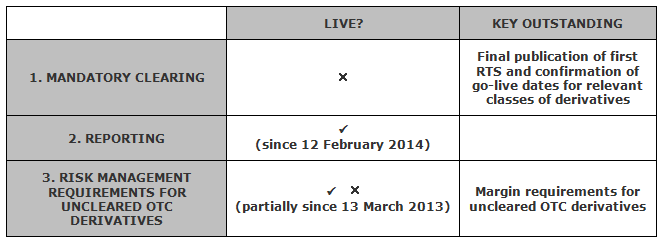

I. Current Status of the Key EMIR Obligations

II. Key New Document Releases and Resources

ISDA EMIR Classification Letter (13 July 2015)

ISDA EMIR Frontloading Additional Termination Event Amendment Agreement (12 June 2015)

Updated ESMA Q&A paper (27 April 2015, the “ESMA Q&A”)[4]

European Commission EMIR FAQ (10 July 2014)

ISDA/FIA Europe Cleared Derivatives Execution Agreement, (May 2014, the “CDEA”)

Association of Corporate Treasurers, Briefing Note: European Regulation of OTC Derivatives, Implications for non-financial companies (May 2014)

ISDA/FOA Delegated Reporting Agreement (January 2014)

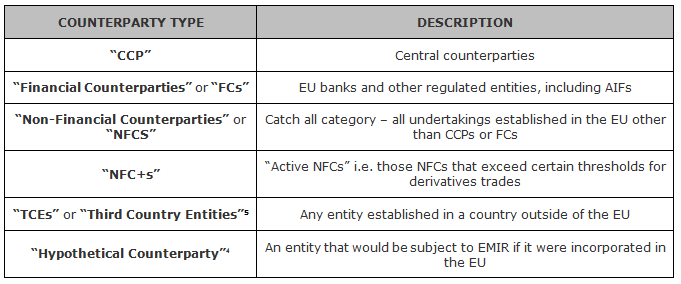

III. EMIR Counterparty Categories

By way of reminder (for formal definitions please see EMIR itself):

IV. Progress on the EMIR Obligations

A. The mandatory clearing obligation

“Europe to begin derivatives clearing from Spring 2016”[6]

What developments have there been and moreover, what will happen in Spring 2016?

RECAP: Does the EMIR clearing obligation apply to me?

The EMIR mandatory clearing obligation applies to all trades between FCs and NFC+s, all trades between FCs or NFC+s and certain Hypothetical Counterparties and on a limited basis to trades between two Hypothetical Counterparties. However, the relief granted to certain pension scheme arrangements was recently further extended to 16 August 2017._[7]_

Key Developments

The authorisation of Nasdaq OMX Clearing AB on 18 March 2014 as an EMIR authorised CCP started the official EMIR clearing clock running and, from such date, ESMA had six months[8] to prepare and submit draft Regulatory Technical Standards (“RTS”) regarding which of those classes of derivatives currently cleared by Nasdaq OMX would be subject to mandatory clearing and from when (the “when” being the heart of the so called “front loading” debate).

Fifteen CCPs[9] have since also received authorisation, most recently the Athens Exchange Clearing House on 22 January 2015. Each CCP authorisation triggers a separate, parallel six-month time period for any classes of OTC derivative not covered by any previous authorisation, pursuant to which the European Commission (the “Commission”) must also prepare draft RTS. ESMA’s Public Register sets out the classes of OTC derivatives that CCPs have been authorised to clear and which, in due course, may become subject to the mandatory clearing obligation.[10] 29 April 2015 marked a significant date internationally since ESMA recognised (CCPs established outside of the EU must be “recognised” rather than “authorised” to constitute a qualifying CCP for the purposes of EMIR) ten third country CCPs established in Australia, Hong Kong, Japan and Singapore, allowing these third country CCPs to provide clearing services to clearing members or trading venues established in the EU. A key jurisdiction awaiting recognition is the US (see Section 5 (Equivalence and extra-territoriality) below for further detail).

ESMA’s July 2014 publication of two Consultation Papers relating to the clearing of certain classes of interest rate and credit OTC derivatives transactions[11] kick started the move towards final RTS. These Consultation Papers covered four key issues: (i) which OTC derivatives will be subject to mandatory clearing; (ii) the counterparty categories for the phased implementation; (iii) the proposed timeline for central clearing; and (iv) the issue of “front loading.” A third Consultation Paper relating to FX non-deliverable forwards (“NDFs”) was published on 1 October 2014[12] (ESMA has since confirmed that it is not proposing a clearing obligation on NDFs at this stage) and on the same date, ESMA’s draft RTS relating to interest rate OTC derivatives were sent to the Commission for ratification. European legislative procedure[13] dictates that the Commission then has up to three months to endorse the draft RTS. On 18 December 2014, the Commission informed ESMA of its intention to endorse the draft RTS with amendments but this stalled on 29 January 2015 when the Commission then sent ESMA a correction. These amendments to the initial draft RTS open a six-week period within which ESMA may amend the RTS on the basis of the Commission’s comments and resubmit in the form of a formal opinion to the Commission.

On 6 March 2015, ESMA sent the Commission its revised opinion, including a second version of the draft RTS. The key open item relates to the Commission's proposal for the application of the EMIR exemption for intra-group transactions from the mandatory clearing obligation to TCEs, which requires an equivalence determination to have been made for the relevant jurisdiction: in the absence of any equivalence determinations, the Commission having proposed that for a maximum period of three years, any third country shall be deemed equivalent for such purposes.

Most recently, on 11 May 2015, ESMA published its latest clearing Consultation Paper, in this case proposing to submit RTS to the Commission relating to classes of OTC interest rate derivatives denominated in certain non-G4 currencies. Comments were invited no later than 15 July 2015 and whilst the Consultation Paper does provide various explanations into certain aspects of the clearing procedure, including clarifications on timing and counterparty categories, it is notably silent on any substantive response to the intra-group issue. At the time of writing, ESMA had just (17 July 2015) published a webpage containing the responses it has received to these latest RTS.[14]

Expected timeline

Since there is no prescribed time frame for the Commission to respond to ESMA’s March submission, exact timing is unknown, although, upon adoption by the Commission, the RTS must simultaneously be notified to the European Parliament and the European Council, who have a minimum period of three months and a maximum of six months to provide feedback. If however, each of the European Parliament and the European Council inform the Commission prior to the expiry of such time periods that they do not intend to raise any objections, the RTS can be published in the Official Journal of the European Union sooner and will come into force 20 days after such publication.

Outside of this formal procedure, market sentiment has held that the mandatory clearing obligation will not go live for any category of counterparty until March or April 2016,[15] a position reaffirmed most recently by a speech on 29 May 2015 by Jonathan Hill.[16]

Even then, on the basis of the current phase-in periods set out in the draft RTS, the clearing obligation would only be effective for those counterparties categorised as “Category 1” i.e. FCs and NFC+s who are current clearing members of at least one of the CCPs authorised or recognised before that date to clear at least one of the relevant classes of derivatives (the entry into force of mandatory clearing for Category 1 being six months following the RTS’ publication). “Category 2” entities (essentially other systemically important FCs and NFC+s) would not follow until twelve months after publication of the RTS. The final two proposed categories, “Category 3” and “Category 4” comprising FCs, which are not otherwise captured by Categories 1 and 2, and AIFs comprising NFC+s (Category 3) and NFC+s not captured by any other Category definition (Category 4) would follow eighteen months and three years following publication respectively. The latest RTS set out in the May 2015 Consultation Paper also propose two separate timelines between the implementation of the first set of RTS relating to the G4 currencies and the latest RTS, relating to non-G4 currencies such that in certain cases there is a delay of at least three months for each counterparty category.

Other clearing related issues

Scope of the clearing obligation. Whilst it remains the expectation that interest rate and credit derivatives will be the first to become subject to mandatory clearing, there is market apprehension regarding which derivatives will follow. Furthermore, front loading, the obligation to clear OTC derivatives that are entered into before the date the clearing obligation applies but after the authorisation notification, has and remains a much debated topic, immediate concern highlighted by way of a letter from ESMA to the Commission[17] published shortly after the publication of the first two Consultation Papers. Around the same time, the European derivatives community’s concern in relation to the front loading requirement was clearly evident, front loading being described as a thorn in the side of the dealer community.[18] The May 2015 ESMA Consultation Paper follows the last RTS in its approach to front loading by applying front loading to Category 1 and 2 FCs only and factoring in a postponement to the start date to allow parties to determine which category they belong to and also, where relevant, to apply for the intra-group exemption.

Account structure.

A crucial issue counterparties must decide upon when making clearing arrangements is account structure, an issue covered generally by Article 39 EMIR (Segregation and Portability), pursuant to which, a CCP must offer the choice of at least an omnibus segregated account (which can be “net” or “gross”) and an individually segregated account (so called “ISA”).

Broadly speaking, the spectrum of account protection is defined at one end by a physical, fully segregated account offering the highest level of protection and a net omnibus account at the other. In practice, each CCP has its own versions of the two basic offerings with different levels of segregation and of course different associated costs. CCPs and clearing members have made available various disclosure documents on the accounts available and, at an industry wide level, ISDA and the FOA have also produced a disclosure document to facilitate compliance with the related EMIR disclosure obligations. Careful consideration should be given to the final choice of account structure, key differences being that a clearing member and CCP may net the transactions recorded in the same omnibus client account across different clients as well as using any assets recorded in the same omnibus account for any other client in the same account, that porting is likely to be more difficult where an omnibus structure is adopted (each client has to agree to use the same back-up clearing broker) and, with respect to an ISA, all excess margin must be passed up to the relevant CCP. Consideration should of course also be given to the local insolvency law analysis of both the clearing member and CCP.

Next steps

Notwithstanding the expectation that the clearing obligation will, at least in the first instance, narrowly apply, those to whom it will apply face a conundrum whether to clear now or wait, the general acceptance being that ultimately pricing will increase for OTC derivatives available for clearing but transacted outside of the clearing space. Whilst our previous experience was many counterparties were seeking to set themselves up for clearing as soon as is possible, it appears now that timing delays and related uncertainties are leading counterparties to retreat and delay incurring associated costs until clarity is obtained.

Market events on the sell-side are further shaping the landscape and any desire to clear must be married with a contracting clearing market; as time passes and regulatory complexities and uncertainties increase (there is concern that capital requirements being set by regulators do not reflect the risk reducing aspects of clearing) and actual and potential costs grow, several institutions are withdrawing from the client clearing space, including most recently Nomura, who in May 2015 confirmed its plans to withdraw from OTC client clearing in both the US and EU. Nomura’s exit follows BNY Mellon, RBS, and State Street, who have also closed their OTC derivatives client clearing units. Such exits could lead to real capacity issues as implementation approaches and eventually becomes effective across counterparty categories.

Clearing documentation and related market publications

ISDA EMIR Classification Letter (July 2015). On 13 July 2015, ISDA published a form of ISDA EMIR Classification Letter which is intended to provide a means by which counterparties can clarify their category status for the application of the clearing obligation (initially relating to the interest rate RTS only) and other EMIR regulatory requirements by answering a series of prescribed questions. Such tools already exist via “ISDA Amend” but this bilateral letter can be used for parties that are not ISDA Amend subscribers.

Client clearing documentation (June 2015). Dealers are adopting different approaches in relation to their client clearing documentation and incorporation of the ISDA/FOA Client Cleared OTC Derivatives Addendum, which has now been in effect for over two years (latest version June 2015) with some opting to use the FOA documentation, referencing the FOA Professional Client Agreement (including provisions relating to collateral) as the “master agreement” and also using the FOA Clearing Module for exchange traded derivatives with other dealers retaining the ISDA structure and referencing instead the ISDA Master Agreement and Credit Support Annex.

ISDA EMIR Frontloading Additional Termination Event (June 2015). ISDA recently published a form of Amendment Agreement relating to a new “front loading ATE”, which provides a means by which parties can update existing ISDAs to include an ATE should transactions subject to the EMIR mandatory clearing obligation not have relevant clearing documentation in place by the date agreed therein.

The CDEA (May 2014). Similarly to the US focused document of the same name, the English law governed CDEA published on 15 May 2014 by ISDA and the FIA facilitates the entry of cleared derivatives transactions with one or more CCPs located outside of the US.For those familiar with the LCH Accession Agreement and related Execution Standard Terms, the CDEA serves the same function albeit on a multi CCP basis.

AIMA’s Guide to Sound Practices, OTC Derivatives Clearing (July 2014). Available to AIMA members, the so called “GSP” provides background and guidance in relation to the clearing obligation as well as highlighting considerations when selecting a clearing member and account structure. The GSP also includes an illustrative clearing member due diligence questionnaire for managers.

ISDA clearing member reliance opinions. From March 2013, ISDA Members have been able to access various clearing member and client reliance opinions.

B. Reporting

RECAP: Does the EMIR reporting obligation apply to me?

All counterparties and CCPs must report details of “any derivative contract”.

General obligation to report

The general EMIR reporting obligation has been in effect since 12 February 2014, following which all EMIR “counterparties” and CCPs must report the details of each new derivative transaction (including all OTC and exchange traded derivatives whether cleared or not) as well as any modification to, or termination of, an existing derivative contract to an ESMA registered trade repository[19] by “T+1” i.e. no later than the working day following the conclusion, modification, or termination of the relevant derivative contract. The reporting obligation as summarised below, together in each case with the respective deadline, also looks back to existing and in some cases terminated contracts:

By:

Relevant trades

12 February 2014:

Trades entered into on or after 16 August 2012 which remain outstanding on 12 February 2014.

13 May 2014:

Trades entered into before 16 August 2012 which remain outstanding on 12 February 2014.

12 February 2017:

Trades terminated between 16 August 2012 and 12 February 2014.

Who should report?

Although the reference to “counterparties” initially caused some confusion, the ESMA Q&A clarify the position, namely that the reporting requirement applies only to FCs and NFCs and does not therefore directly apply to TCEs, although the reality being that often TCEs may be requested either to report or to provide certain information (e.g. its LEI) in order to assist its EU based counterparty with their EMIR reporting obligations. In the latter case, the EU based entity is required to make a note on the “Counterparty Data” section (see below) of its report that its counterparty is a non-EU counterparty.

Which derivatives should be reported?

The reporting requirement covers derivatives in all asset classes (interest rates, credit, foreign exchange (“FX”), equities and other commodities). In relation to FX transactions it is important to bear in mind that:

FX spot transactions are not considered to be derivatives and are therefore not subject to the reporting obligation (the same analysis being applicable to spot transactions in other asset classes);

even following the reporting go-live date, there continues to be a lack of harmonization amongst EU regulators regarding what constitutes a derivative for the purposes of EMIR, in particular whether or not FX forwards are derivatives and therefore subject to the EMIR reporting obligation. As detailed in the September 2013 Stay Current, EMIR’s “Derivative or derivative contract” is defined by reference to the MiFID[20] definition of “Financial Instruments”, which includes a very general definition of derivatives instruments, including “options, futures, swaps, forward rate agreements and any other derivatives contracts relating to securities, currencies, interest rates or yields, or other derivatives instruments, financial indices or financial measures, which may be physically settled or in cash”. Uncertainty remains as a consequence of different applications of MiFID across EU Member States, in particular regarding what exactly (and when a transaction) will constitute an “FX forward” and therefore an FX financial instrument as opposed to an FX spot transaction, the former being caught by EMIR whereas the latter is not. From a UK perspective, it is understood that for the Financial Conduct Authority’s (“FCA”) purposes, FX forward transactions are outside the scope of MiFID and thus EMIR, provided those FX forwards are entered into for commercial rather than investment purposes; and

notwithstanding the April 2014 Commission consultation document “FX Financial Instruments”[21] no further specific guidance has been issued defining an FX derivative, meaning that a standard definition that will apply across the EU will almost certainly not be available until MiFID 2[22] and its associated implementing measures apply, therefore not until 3 January 2017, the current expectation being that as part of the implementation of MiFID 2, the Commission will issue a delegated act in relation to the definition of derivative.

Is there a prescribed way to report?

The Commission has adopted RTS and implementing technical standards (“ITS”) to ensure a level of consistency regarding the application and frequency of the reporting requirement. The RTS and ITS specify that each report shall at least contain: (i) details relating to each of the parties to the derivative contract (“Counterparty Data”—“Table 1” of each of the RTS and ITS); and (ii) details of the main characteristics of the derivative contracts, including their type, underlying maturity, notional value, price and settlement date (“Common Data”—“Table 2” of each of the RTS and ITS), together the two tables resulting in up to 85 data fields to be completed.

Does EMIR permit delegation of the reporting requirement?

A party can choose to delegate reporting to its counterparty or a third party service provider although the obligation to comply and therefore ultimate responsibility to report remains with the delegating party. Counterparties must also ensure details of their derivative contracts are reported without duplication and counterparties should have procedures in place to ensure that the Common Data is agreed before a single report per derivative transaction is submitted to an ESMA registered trade repository.

Exposure reporting (including both collateral and valuation information)

From and including 12 August 2014, FCs and NFC+s have to comply with further reporting obligations fields 17-26 of Table 1, including providing daily collateral (i.e. the total market value that has been posted by the counterparty responsible for the report, including initial margin on a portfolio rather than single transaction basis) and valuation information (the value being based on the end-of-day settlement price of the market (or the valuation of the CCP) from which the prices are taken as reference, or on the closing mid-price of the market concerned) in relation to any OTC or exchange-traded derivatives trades. Such information must be reported to a registered trade repository following the execution of a trade and thereafter, following any modifications of the value or upon termination. These reporting obligations can also be delegated to a third party on the same basis as briefly mentioned above.

As with the general EMIR reporting obligation, the requirement to report exposure has been front-loaded as follows:

By:

Relevant trades

12 August 2014:

Trades entered into on or after 16 August 2012 which remain outstanding on 12 August 2014.

13 November 2014:

Trades entered into before 16 August 2012 which remain outstanding on 12 August 2014.

12 August 2017:

Trades terminated between 16 August 2012 and 12 August 2014.

Market documentation initiatives

Reporting to a trade repository requires a significant amount of resources and preparation (e.g. establishing internal systems and selecting and registering with a trade repository) and as a result many non-dealer counterparties have sought to delegate their reporting obligation to their dealer counterparty or a third party service provider. In response, many swap dealers have developed their own “house” reporting delegation agreements, although these are understandably one-sided given that there is no obligation for dealers to offer such reporting services and a number are offering this service at no extra cost. As a result, many counterparties have had to choose between accepting a delegation agreement on unfavourable terms or building the infrastructure to be able to report on their own behalf. ISDA has facilitated the reporting and delegation process by producing the following standard documents:

Reporting Guidance Note (July 2013). On 19 July 2013, ISDA published a reporting guidance note to assist market participants with their consideration of reporting issues. The note also provides examples of language which might be useful to facilitate bilateral agreement between parties to an ISDA Master Agreement to update its terms to reflect certain respective obligations in relation to reporting and the delegation thereof.

The ISDA FOA EMIR Delegated Reporting Agreement (the “DRA”) (January 2014). On 13 January 2014, ISDA and the FOA published a standalone form English law governed delegated reporting agreement. The DRA contemplates that one party (the “Reporting Delegate”) will, on behalf of the other, submit certain data relating to specific derivative transactions to the trade repository agreed at the outset by the parties. Although ISDA consulted with both buy and sell side participants when drafting the DRA, there are a number of key concerns to be considered by buy-side counterparties when negotiating the DRA, including:

the limited level of commitment to report that the Reporting Delegate assumes. Pursuant to the DRA, the Reporting Delegate will have the sole discretion to determine whether the reporting obligation has arisen and the deadlines for such reporting. It would be best practice to link any deadlines to those prescribed by EMIR;

the broad force majeure provision and broad indemnity in favour of the Reporting Delegate; and

that in any event, since even when delegated, liability for EMIR reporting remains with each party to a derivative transaction, parties should: (i) maintain some level of oversight (e.g. being able to check the reports submitted on their behalf or have access to them); and (ii) have a back-up-plan to the extent their Reporting Delegate has not reported or has terminated the DRA.

Next steps

Despite the fact that the ESMA registered trade repositories are processing over 300 million trade reports on a weekly basis and have collectively seen more than 16.5 billion reports in the period from mid February 2014 to the end of May 2015,[23] Verena Ross, the executive director of ESMA earlier this year commented that “it is rare to see data quality at an acceptable level”.[24] This is of particular concern given that since 1 December 2014 European regulators have started to impose fines for the faulty reporting of swap trades.

In November last year ESMA launched a consultation to revise the existing reporting RTS and ITS to clarify the interpretation of the data fields required for reporting to trade repositories and the most appropriate way of populating them. Although the consultation period ended on 13 February 2015, ESMA is yet to propose any formal amendments to the RTS and ITS and accordingly, reporting parties need to continue to comply with the existing rules given that they continue to be in force as of the date hereof. However, the ESMA Q&A[25] do confirm a new two-step validation process for trade repositories which seeks to ensure that reporting is performed according to such new regime. Other concerns and difficulties still remain in relation to specific fields for reporting including the much discussed unique trade identifier (“UTI”) (still without international agreement although ISDA best practice guidance is available[26]), which must be mutually agreed and assigned to the transaction report, as well as concerns relating to intra-group reporting (there is no exemption for intra-group reporting) and the related operational burden of obtaining an LEI for every entity in the group.

On 15 June 2015, a group of eleven of the financial industry’s most high profile trade associations (including AIMA) published a letter supporting a set of principles developed by ISDA aimed at improving consistency in regulatory reporting standards for derivatives and urging regulators around the world to agree on consistent and harmonised reporting standards for the international market to adhere to. Differences in requirements clearly lead to increased costs and complexity for all but in the absence of harmonised standards and any equivalence or similar decisions, a party subject to multiple derivatives regulatory regimes should seek to ensure compliance with each jurisdiction’s requirements. One common concern with EMIR reporting is the two sided nature of the reporting obligation, contrasted with, for example, single sided OTC derivatives reporting in the U.S..

More generally, concern has also been expressed regarding the potential overlap between the EMIR reporting regime and transaction reporting required by MiFID 2 and MiFIR,[27] in particular that certain derivative transactions could be within the scope of each of EMIR, MiFID 2, MiFIR and “REMIT”.[28] As briefly touched on above given that MiFID 2 will not be applicable until early 2017 this will no doubt be another issue for European regulators to consider in the near future.

C. Risk Mitigation Techniques for Non-Cleared OTC Derivatives

RECAP: Do the risk mitigation techniques apply to me?

All types of EMIR counterparty as well as TCEs in specific cases must comply with at least certain of these EMIR obligations, the exact level of compliance being dependent on individual counterparty type.

The RTS for this EMIR category are almost complete and many of these requirements have already been in effect for some time; “timely trade confirmation” since 15 March 2013 and those relating to portfolio reconciliation, portfolio compression and dispute resolution since 15 September 2013.

As reported in the September 2013 Stay Current, the risk mitigation techniques will also apply to Hypothetical Counterparties and TCEs in certain prescribed circumstances. The then draft RTS regarding direct, beneficial and foreseeable effect have now been published in the Official Journal of the European Union and took effect from 11 April 2014 in relation to the anti-evasion provisions and from 10 October 2014 in relation to the direct and beneficial effect provisions, in each case the key requirements remain largely unchanged from the draft RTS and notably which will not apply where both TCEs are established in third countries that benefit from an equivalence determination.

In summary an OTC derivative will have “direct, substantial and foreseeable effect” where at least one TCE (from a non-equivalent third country only) benefits from a guarantee provided by a FC covering all or part of its liability resulting from the relevant OTC derivative, provided the guarantee meets each of the following conditions (a) the guarantee is in an aggregate notional amount exceeding EUR 8 billion or the pro rata equivalent for partial guarantees and (b) such guarantee is in an amount at least equal to five per cent. or more of the sum of current derivatives exposures of such FC guarantor. An OTC derivative contract shall also be considered as having a direct, substantial and foreseeable effect when both TCEs enter into the relevant derivative through branches in the EU and are Hypothetical Counterparties. In relation to the anti-evasion provisions, an OTC derivative shall be deemed to have been designed to circumvent the application of EMIR if when viewed as a whole and having regard to all the circumstances, it is considered to have as its primary purpose the avoidance of any of EMIR’s provisions.

Two further developments of note in relation to those obligations already in effect are: firstly, in its late 2014 update to its page “FCA supervisory priorities arising from EMIR”, largely relating to 2015 areas of focus, the FCA highlighted that it expected firms to have a detailed and realistic plan to achieve compliance with the risk mitigation techniques for non-cleared trades relating to portfolio reconciliation, dispute resolution and compression within the shortest time possible and that such plans should have been implemented by (and firms should be able to demonstrate compliance since) 30 April 2014; and secondly, the ISDA publication in May 2015 of updated operational guidance in relation to EMIR portfolio compression.[29] The remainder of this section focuses on the final outstanding risk mitigation technique that relates to margin and capital requirements applying to non-centrally cleared OTC derivatives.

Key developments

Following the publication by the Basel Committee and IOSCO of the final policy framework establishing minimum standard for margin requirements for non-centrally cleared derivatives,[30] 14 April 2014 marked an important milestone for the European development of the final outstanding risk mitigation techniques, with the joint publication by the European Supervisory Authorities (“ESAs”)[31] of a Consultation Paper including draft RTS.[32] This Consultation Paper has recently been complemented by a second ESA Consultation Paper,[33] which builds on the first and on which comments were invited by 10 July 2015. At the time of writing, the European Banking Authority had just (15 July 2015) published a webpage containing the responses it has received to this Consultation Paper.[34]

The key items covered by the consultation papers and related RTS relate to the entities that will be captured by the obligation; margin models to be used; what will constitute eligible collateral; and related operational and risk management processes. The key proposals of note include:

Relevant counterparties. The intention remains that the risk management procedures relating to initial and variation margin will only apply to systematically important FCs and NFCs including transactions entered into by either an FC or NFC+ and a Hypothetical Counterparty (two-way margin collection where the requirements apply). Two NFCs (or TCEs which would be NFCs if they were established in the EU) transacting together can agree not to exchange initial and variation margin.

Phased in approach.

Largest entities will be subject to the requirements first with smaller entities given more time to comply. This remains the case following the new consultation paper, although the date at which the first set of counterparties to whom restrictions will apply has been delayed from 1 December 2015 to 1 September 2016[35] (at the earliest).

From 1 September 2016, initial margin must be posted where both counterparties have or belong to groups each of which has an aggregate average notional amount of non-centrally cleared derivatives above EUR 3 trillion, following which, over the four years until September 2020, application will be staggered, the only exemption to the posting of initial margin being where at least one of the counterparties has aggregate average notional of less than EUR 8 billion.

There are also new phased in requirements for the daily calculation of variation margin (and relevant exchange within three business days from the calculation date). For those entities that exceed the EUR 3 trillion threshold, posting will start in September 2016, whereas for other firms posting will commence in March 2017.

No retrospective effect. The new margin requirements will apply to contracts not cleared and entered into after the relevant phase-in dates. Exchanges of initial and variation margin on transactions not cleared by a CCP entered into before these dates are subject to existing bilateral agreements. Notwithstanding this, the Consultation Paper does state “…within reasonable limits, market participants should strive to extend the requirements to the widest set of non-centrally cleared OTC derivatives possible”.[36]

Amount and calculation of margin, collateral categories and types.

Parties can agree bilaterally to include an initial margin threshold of up to EUR 50 million, below which no initial margin need be transferred.

There will be a de minimis level of initial and variation margin of up to EUR 500,000 (also to be agreed bilaterally).

There will be prescribed use of one of three initial margin methods being (1) an initial margin model created by one or both of the counterparties, (2) a third party agent created initial margin model, or (3) the “Standardised Method.” As further detailed below ISDA is working on the ISDA standard initial margin model (“ISDA SIMM”) which could be adopted by market participants.

It can be agreed not to post initial margin in relation to certain types of FX transaction.

Firms will need to be prepared to notify relevant National Competent Authority(ies) if intending to use an initial margin model and to provide relevant documentation. Such NCA will then decide if the model proposed is appropriate.

Collateral must generally be liquid and of high grade; therefore cash and other highly liquid securities such as government securities, corporate bonds and most senior tranches of a securitisation and securities will be subject to concentration limits to avoid risks associated with having to quickly liquidate the securities of a single security/issuer. The RTS set out the list of eligible collateral, eligibility criteria, requirements for credit assessments and requirements regarding the calculation and application of haircuts. Counterparties can agree bilaterally to use a more restrictive subset of collateral.

Initial margin will be subject to restrictions relating to segregation and re-hypothecation/reuse.

Intra-group exchanges. Intra-group transactions can be exempted from the obligation to exchange collateral in limited circumstances prescribed by EMIR and depending on the type of counterparties and where they are established, there is either an approval or a notification process. To seek to harmonise the relevant operational procedures, the draft RTS set out a clear procedure for the granting of intra-group exemptions.

ISDA Working Group on Margin Requirements (the “ISDA WGMR”)

The ISDA WGMR comprises six industry groups to help prepare for implementation of the non-cleared margin rules. A central focus for the ISDA WGMR is developing a common model for calculating initial margin, the so called ISDA SIMM. The ISDA WGMR believes that the ISDA SIMM will reduce the amount of initial margin required, will provide greater transparency and will allow firms to manage margin and forecast liquidity quickly, at a low cost, in a predictable easy to replicate way. Once finalized the ISDA SIMM will need to be implemented and tested by market participants and approved by national authorities.[37] The project continues to gather pace and on 19 June 2015, ISDA published three draft documents relating to the model. Ultimate success of the ISDA SIMM will however be determined by obtaining regulatory approval of the ISDA SIMM and general market take-up.

International application and differences

As well as contending with timing and implementation concerns, firms have also raised concerns as to the inconsistencies between the various national proposals, a concern clearly acknowledged by the regulators themselves: “We recognise the importance of having the uncleared margin rules of different jurisdictions be as consistent as possible. We do not want to create the potential for regulatory arbitrage or disruption in the market by creating unnecessary differences”.[38] Despite national rules on margin requirements for uncleared derivatives for each of the US, Europe and Japan being proposed in 2014, no final rules have been published to-date.

The latest ESA consultation paper clearly acknowledges the importance of international convergence on these issues and in the executive summary states “… a number of specific issues have been clarified so that the proposed rules will implement the international standard while taking into account the specific aspects of the European financial market …”.[39] Firms appear to be particularly concerned as to the divergence of the EU and US rules on margin and the possibility of accidental non-compliance. The current discrepancies include differences in applicability thresholds, what will constitute eligible collateral and differences in collateral concentration limits (the US not currently considering a concentration limit).

Next steps

Self-Assess — work out which rules apply, how and from when: Only when the final rules are published by the main jurisdictions will entities be able to ready themselves and given the potential differences across international rules as outlined above, a key aspect is obtaining clarity on the application of cross border rules. Once in effect, it will be important for firms to regularly assess the applicability of the various margin rules and regulations, to clarify their status and that of their counterparties under the rules (ISDA is expected to produce a self-disclosure form in this regard), to consider relevant thresholds (always considering other group entities) and to confirm (and be able to evidence) that they are complying to the right level.

Update Documentation: Firms will need to update or replace their collateral documentation so as to ensure they comply with the relevant regulatory requirements; for example Credit Support Annexes (“CSAs”), including provisions relating to collateral eligibility, collateral haircuts, calculation and collection timing, dispute resolution and segregation requirements and possible coverage under multiple regulatory regimes. Further documents to consider amending in anticipation of implementation are custodial agreements, netting opinions and perhaps even the need to provide for duplicate ISDA Master Agreements given the different rules across various jurisdictions. Given the staggered implementation of initial margin, it is likely that firms will first focus on amendments required in relation to variation margin terms rather than initial margin. Templates are being prepared by the ISDA WGMR for New York, English and Japanese law governed transactions and although exact document architecture is still being considered, in the first instance it is expected that existing CSAs will work alongside a new separate CSA under a single ISDA Master Agreement. For those entities with existing (non-regulatory) initial margin arrangements in place, careful consideration will have to be given to how such existing margin arrangements will be affected (and/or preserved) following the regulatory initial and variation margin requirements taking effect and how the agreed arrangement will be documented going forward.

Implement relevant operational processes and technologies: Firms will need to develop technology to calculate margin requirements in real time, as well as establish processes to post and collect margin. As recently as 7 July 2015, it was reported that thirteen major global banks, ICAP, DTCC and Euroclear have joined forces to invest in a new end-to-end margin processing hub for non-cleared derivatives.[40]

V. Equivalence and Extra-Territoriality

“Global derivatives markets need worldwide standards and national rules that work together seamlessly.”

A bold but very valid statement from Commissioner Barnier,[41] but the reality is that on the eve of EMIR’s three year anniversary equivalence and extra-territoriality remain a regulatory enigma: the current reality as highlighted by Scott O’Malia, ISDA Chairman, “[In the absence of a transparent and effective process for recognising and deferring to comparable regimes globally active derivatives firms] face duplicative and even contradictory rules because regulators did not fully consider how their domestic regimes would align with other jurisdictions” still a gulf away from the path originally defined by the Leaders Statement at the Pittsburgh Communique following the September 2009 G20 summit to “implement global standards consistently in a way that ensures a level playing field and avoid fragmentation of markets, protectionism, and regulatory arbitrage”.

By way of reminder, focus on EMIR’s international reach emanates from two key aspects of EMIR — those EMIR provisions which directly impose mandatory clearing obligations and risk mitigation techniques on certain transactions between two TCEs and EMIR’s “equivalence”[42] concept, pursuant to which the Commission can declare that the “legal, supervisory and enforcement” arrangements of a third country are equivalent in relation to clearing, reporting and risk mitigation, with the effect that counterparties shall be deemed to have fulfilled their EMIR obligations to clear, report and observe risk mitigation techniques where at least one of the counterparties is established in that third country. It is equivalence that is and remains a key focus.

The key immediate unresolved issue relating to equivalence is the mutual recognition of US CCPs in Europe and related capital charges: in summary if US CCPs are not recognised pursuant to EMIR, when European banks use US CCPs to clear trades, they will face higher capital charges. In addition, EMIR’s rules state that once mandatory clearing becomes effective, counterparties can only use international CCPs which are recognised pursuant to EMIR. Whilst the US and EU are coming closer to an agreement, issues relating to margin remain outstanding, specifically that in Europe CCPs should calculate margin on a two-day basis and in the US on a one-day basis, which it has been indicated could require a 41 per cent. increase in margin in Europe, as well as differences on the basis on which margin is held, the US requiring margin in client accounts to be held on a gross basis, whereas Europe allows posting in relation to client accounts on a net basis. In response to this continued discord, the Commission recently extended the transitional period for capital requirements for EU banking group’s exposures from 15 June 2015 to 15 December 2015, avoiding higher capital charges being imposed on EU banks clearing through CCPs which are not authorised or recognised under EMIR. EU and US regulators therefore have six more months to resolve differences, although at the time of writing, the debate continues without resolution.

Notwithstanding this current road block, some progress on equivalence has been made: following the 30 October 2014 adoption of its first “equivalence” decisions relating to the regulatory regimes of CCPs in Australia, Hong Kong, Japan and Singapore, (as also referenced above) on 29 April 2015, 10 clearing houses established in those jurisdictions received recognition from the Commission.

Although these CCP related equivalence determinations are the first equivalence decisions to be adopted by the Commission, steps are underway in relation to equivalence in other EMIR areas and for other jurisdictions. On 9 September 2013, ESMA published certain technical advice to the Commission on third country regulatory equivalence in respect of Australia, Hong Kong, Japan, Singapore, Switzerland and the United States. On 2 October 2013, further advice was then published in relation to the regulatory regimes of Canada, India and South Korea as well as supplements to the assessment already produced for Australia, Hong Kong, Singapore and Switzerland. At the time the advice was provided, ESMA found the regulatory regimes of Australia, Hong Kong and Switzerland for CCPs equivalent to EU rules and otherwise conditional equivalence across the different areas for different jurisdictions was proposed. The Commission is expected to use ESMA’s technical advice[43] to prepare possible equivalence decisions.

Whilst these equivalence determinations remain under formal consideration, wider industry consideration and discussion continues as regards how best to approach and make the equivalence (or analogous) decision itself. IOSCO has suggested it may be able to play a role, drawing up a set of principles — perhaps similar to those published by ISDA back in August 2013 — and intermediating in equivalence (and similar) determinations and ISDA continues to raise awareness of, and seeks to take forward, these issues. However, notwithstanding such discussions, for the moment they continue to be only that and there has been no formal adoption or global agreement to-date as regards a unified approach to cross border application and acknowledgement of related national derivatives laws and regulations.

VI. Closing note

Whilst progress on the implementation of EMIR is evident and indeed EMIR is now mature enough to warrant a Commission led public consultation in relation to its implementation to-date,[44] our closing note for EMIR in the coming months can only echo the very apt sentiment of Jonathan Hill expressed recently:

“So a lot done, but a lot to do.”[45]

***

[1] Commission Delegated Regulations (EU) No 148/2013, supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories with regard to regulatory technical standards on the minimum details of the data to be reported to trade repositories.

[2] David Wigan, “MiFID lowers swaps liquidity bar”, International Financing Review, 10 January 2015.

[3] http://www.paulhastings.com/docs/default-source/PDFs/staycurrent-emir-september-2013.pdf

[4] http://www.esma.europa.eu/system/files/2015_775_qa_xii_on_emir_implementation_april_2015.pdf.

[5] Not specifically defined in EMIR.

[6] James Rundle, “Europe to begin derivatives clearing from Spring 2016”, Financial News, 29 May 2015.

[7] European Commission Delegated Regulation of 5 June 2015 amending Regulation (EU) No 648/2012 of the European Parliament and of the Council as regards the extension of the transitional periods related to pension scheme arrangements. At the time of writing, such extension was awaiting an official confirmation of non-objection from the European Parliament, having recently received the same from the Counsil of the European Union.

[8] Article 5 (Clearing obligation procedure), EMIR.

[9] https://www.esma.europa.eu/system/files/ccps_authorised_under_emir.pdf (“List of Central Counterparties authorised to offer services and activities in the Union”, pages 1-2).

[10] http://www.esma.europa.eu/system/files/public_register_for_the_clearing_obligation_under_emir.pdf.

[11] ESMA Consultation Paper on the Clearing Obligation under EMIR (no. 1) ESMA/2014/799, dated 11 July 2014 and ESMA Consultation Paper on the Clearing Obligation under EMIR (no. 2) ESMA/2014/800, dated 11 July 2014.

[12] ESMA Consultation Paper on the Clearing Obligation under EMIR (no. 3) ESMA/2014/800, dated 1 October 2014.

[13] Article 10 (Regulatory technical standards), Regulation (EU) No 1095/2010 of the European Parliament and of the Council of 24 November 2010 establishing a European Supervisory Authority (European Securities and Markets Authority), amending Decision No 716/2009/EC and repealing Commission Decision 2009/77/EC.

[14] http://www.esma.europa.eu/consultation/Consultation-No-4-Clearing-Obligation-under-EMIR

[15] Chris Hall and Tim Cave, “EMIR clearing rules set for delay of up to a year”, Financial News, 7 April 2015.

[16] Jonathan Hill, European Commissioner for financial stability, financial services and capital markets union, European Commission Speech, “First steps in the review of EMIR, the European derivatives regulation”, Brussels, EMIR public hearing, 29 May 2015.

[17] http://www.esma.europa.eu/system/files/2014-483_letter_to_european_commission_re_frontloading_requirement_under_emir.pdf (8 May 2014, ESMA/2014/483).

[18] Christopher Whittall, “End-users prep for EMIR clearing”, International Financing Review, 30 May 2014.

[19] As at the date of this Stay Current, the following entities are registered as ESMA trade repositories: DTCC Derivatives Repository Ltd, Krajowy Depozyt Papierów Wartosciowych S.A., Regis-TR S.A., UnaVista Limited, CME Trade Repository Ltd., ICE Trade Vault Europe Ltd.

[20] Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC.

[21] European Commission Consultation Document, “FX Financial Instruments”, 10 April 2014.

[22] Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU.

[23] Verena Ross’ keynote speech of 9 June 2015 at IDX 2015.

[24] Ibid.

[25] In particular “TR Question 20b”, “Article 9 of EMIR—Reporting to TRs: TR validations of EMIR reports.”

[26] ISDA UTI Trade Identifier (UTI): Generation, Communication and Matching, as of 8 May 2015.

[27] Regulation (EU) No 600/2014 of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Regulation (EU) No 648/2012 Text with EEA relevance.

[28] EU regulation on wholesale energy and market integrity and transparency.

[29] 12 May 2015, ISDA Portfolio Compression EMIR Operations Market Practice Guidance which supersedes the previous Portfolio Compression EMIR Operations Market Practice Guidance published on 18 October 2013.

[30] Basel Committee on Banking Supervision, Board of the International Organization of Securities Commissions, “Margin requirements for non-centrally cleared derivatives”, September 2013.

[31] Such ESAs comprising the European Banking Authority, the European Insurance and Occupational Pensions Authority and the European Securities and Markets Authority.

[32] ESA Consultation Paper relating to draft regulatory technical standards on risk-mitigation techniques for OTC‑derivative contracts not cleared by a CCP under Article 11(15) of Regulation (EU) No 648/2012, 14 April 2014.

[33] https://eiopa.europa.eu/Publications/Consultations/JC-CP-2015-002%20JC%20CP%20on%20Risk%20Management%20Techniques%20for%20OTC%20derivatives.pdf.

[34] https://www.eba.europa.eu/regulation-and-policy/market-infrastructures/draft-regulatory-technical-standards-on-risk-mitigation-techniques-for-otc-derivatives-not-cleared-by-a-central-counterparty-ccp-.

[35] The delay of 9 months was released by Basel and IOSCO at an international level (https://www.iosco.org/news/pdf/IOSCONEWS373.pdf).

[36] Ibid, 30, p25.

[37] Ibid, 30, Article 1 MRM “Initial Margin Models”; model must be endorsed by the European Union. The explanatory text to the referenced Article in conjunction with the WGMR Implementation Program, WGMR Margin and Collateral Processing Workstream, “Minimum Standards Document for the Future State Margin Workflow”, updated on 7 November 2014, sets out that the regulatory approval process for the ISDA SIMM is pending regulatory guidance and coordination of the model approval process across regulators still needs to be tackled.

[38] Timothy Massad, CFTC Chairman, FIA IDX Derivatives Expo, quoted in “Europe consults on uncleared swap margin”, IFR, 13 June 2015.

[39] Ibid, 33.

[40] “Joint effort announced for OTC swaps margin utility”, Automated Trader, 7 July 2015.

[41] Statement by Commissioner Barnier on Global Derivatives, Brussels 27 June 2014.

[42] Article 13 (Mechanism to avoid duplicative or conflicting rules), EMIR.

[43] Relevant technical advice publicly available through the ESMA website at http://www.esma.europa.eu/fr/page/Third-non-EU-countries

[44] http://ec.europa.eu/finance/consultations/2015/emir-revision/index_en.htm. A related public hearing was held on 29 May 2015 and comments (except in relation to reporting which is subject to separate review) are invited by 13 August 2015.

[45] Ibid, 14.

Contributors