Benefits Bulletin

Tax Filing and Your 1095-C

February 13, 2017

Benefits Team

If you were benefit-eligible any time in 2016, you will receive a 1095-C tax form. It will contain information about your health care coverage or offer of health care coverage. The forms are scheduled to be mailed on or around March 2, 2017. When you receive this form, it is important that you keep it for your records.

The 1095-C contains detailed information about medical coverage that was provided by or offered by the Firm. If you were covered through PH, you can think of the form as your “proof of insurance” for the IRS. Without this, the IRS could charge you a penalty for failing to have health care coverage as required by the Patient Protection and Affordable Care Act (PPACA).

What You Need to Know About The 1095-C:

If you worked at more than one employer, you may receive a 1095-C from each employer.

If you were not benefit-eligible at any time in 2016, then you may not receive a 1095-C.

You may not receive a 1095-C if you were not the primary insured (i.e., if you were covered as a dependent on someone else’s plan).

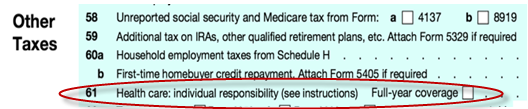

You DO NOT need the 1095-C to complete your 2016 tax filing. The IRS states that taxpayers comply with minimum essential coverage filing requirements by checking a box on Form 1040 confirming coverage for the year (see below) – you do not file your 1095-C with your tax return.

If, after receiving your 1095-C, you have questions, contact Benefits-Firmwide. You may also visit IRS.com or healthcare.gov to learn more.